-

Kenyans prefer in-office work as demand for office spaces remains strong despite global remote trends, with stable rents and a shift towards sustainable buildings.

-

5000 affordable housing units are now available across Kenya, boosting homeownership and economic growth while addressing the country’s housing deficit.

-

Kenya plans its first nuclear plant by 2027, investing KES 500B to boost energy security and industrial growth and reduce reliance on fossil fuels.

-

BOA reduces lending rates from 18.59% to 17.59%, easing loan costs for businesses and individuals. The new rate applies immediately for new loans.

-

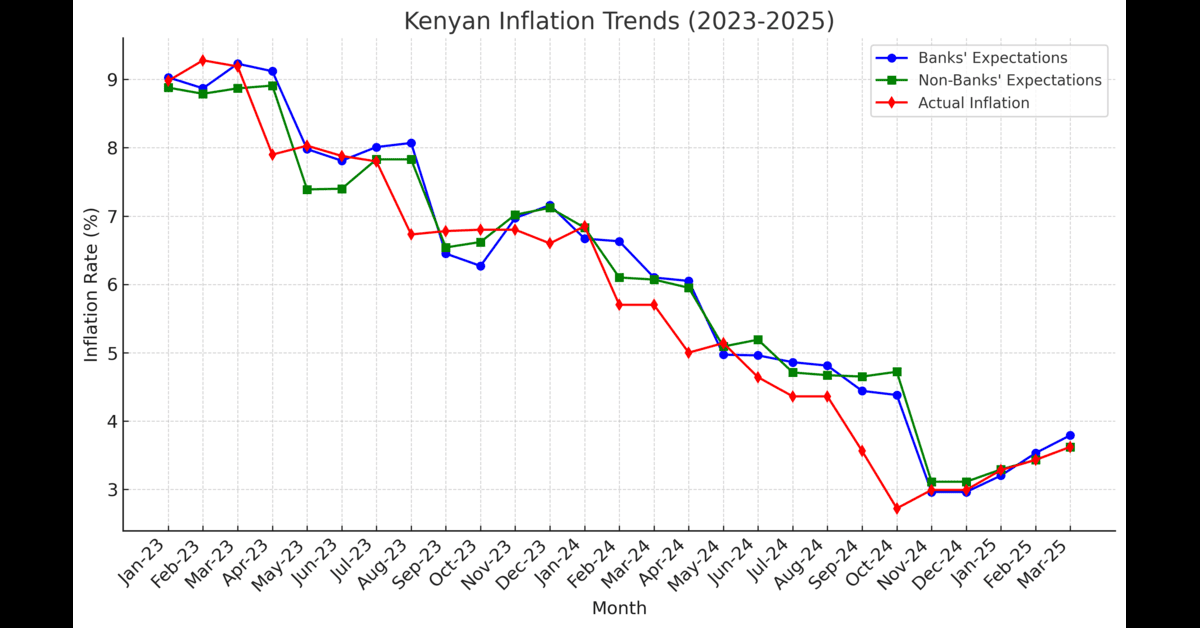

Inflation impacts bank profitability by increasing income while raising costs and risks. Effective management is key to maintaining stability and growth.

-

Kenya enforces new Sand Harvesting Regulations to ensure sustainability, protect the environment, and regulate the industry with strict licensing and penalties.

-

KenGen’s forum provides procurement opportunities for youth, women, and people with disabilities, increasing their access to government contracts and support.

-

Digital finance is transforming global markets, driving innovation, enhancing inclusion, and reshaping regulations for a more efficient financial future.

-

The Kenya Shilling stability continues, maintaining a steady exchange rate amid robust foreign exchange reserves and increasing remittances in early 2025.