The Kenya Revenue Authority (KRA) is making significant changes to enhance tax services for businesses and individuals. KRA has launched a strategic plan to streamline tax payment processes, making them more efficient, personalized, and user-friendly. The goal is to ensure that taxpayers receive better support, reduce frustrations, and make compliance easier.

Related Article: KRA Amnesty: Settle Your Taxes and Save Big Today

KRA Focuses on Customer Needs

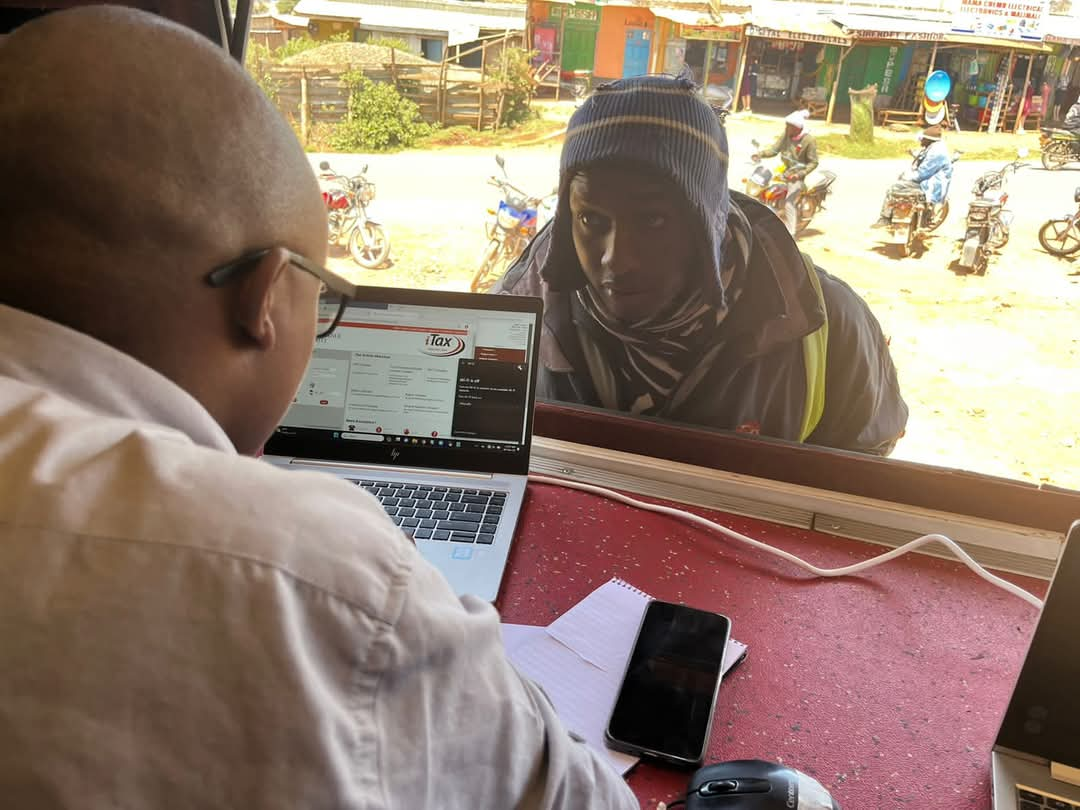

KRA aims to simplify tax procedures and improve customer experience. The new changes focus on providing tailored services to different taxpayers. Through process optimization and advanced technology implementation, KRA seeks to enhance tax administration and provide better service delivery.

As part of this transformation, KRA is restructuring its operations by segmenting taxpayers into specific groups. Large and medium businesses will have a dedicated support team, while small businesses and micro taxpayers will receive specialized assistance. This approach ensures that each group gets the help they need, improving voluntary compliance and making tax payments less stressful.

KRA Introduces Technology for Better Service

Technology is a key part of KRA’s new strategy. A newly established department, the Business Strategy Technology, and Enterprise Modernization Department, will oversee the digital transformation of tax services. This department will automate processes, enhance data-driven decision-making, and guarantee seamless tax administration. With enhanced digital tools, taxpayers will experience faster, more efficient, and user-friendly services.

KRA’s Plan for the Future

These reforms align with KRA’s 9th Corporate Plan, which focuses on enhancing efficiency, promoting voluntary compliance, and leveraging technology for better service delivery. The changes will help businesses and individuals comply with tax laws while reducing administrative burdens.

KRA reassures the public that service delivery will continue uninterrupted during this transition. The authority remains committed to simplifying tax compliance and making it more efficient for all taxpayers. By embracing digital tools and refining its approach, KRA sets a new standard in customer-centric tax administration.