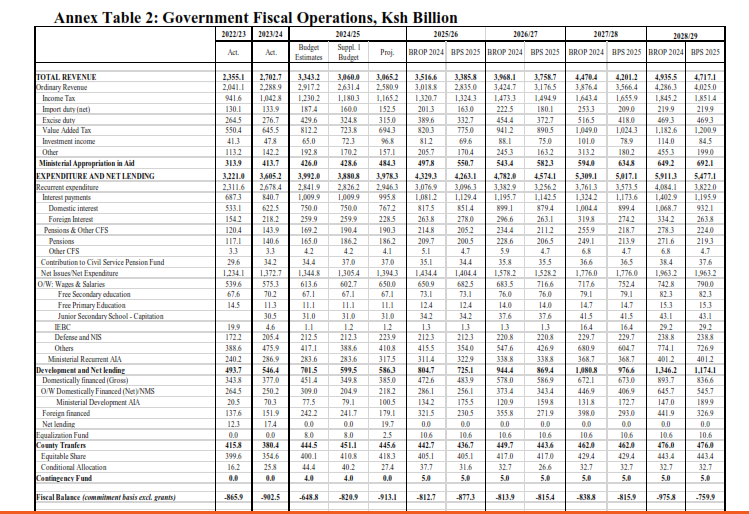

Kenya’s debt is growing, and the country faces an elevated risk of debt distress. The latest Debt Sustainability Assessment by the International Monetary Fund (IMF) shows that while the nation’s debt remains manageable, it has exceeded critical benchmarks. The present value (PV) of Kenya’s public debt is 63.0% of GDP, surpassing the 55% threshold. The government’s fiscal plan targets reducing the national debt by November 2028. Global economic crises and increased borrowing expenses create difficulties.

Debt Sustainability: A Balancing Act

Despite assurances of debt sustainability, Kenya’s economic outlook remains uncertain. The amount the government owed grew a lot in 2023 because the currency weakened and interest rates were high. However, there was some relief by mid-2024 as the exchange rate improved. According to IMF projections, Kenya’s debt-to-GDP ratio should decline to around 55% by 2028. The reduction will likely happen through careful government spending and borrowing money at favorable rates.

External Debt Pressures Mount

The external debt situation is concerning. Experts expect Kenya’s overseas debt to stay within safe limits, meaning it will not exceed 40% of its GDP. However, external debt service obligations, notably revenue and exports, are breaching critical limits. From 2024 to 2028, the debt service-to-revenue ratio will remain above the 18% sustainability benchmark. The maturity of a sovereign bond in June 2024 has intensified short-term debt pressures.

Related Article: Development Crisis: Kenya’s Growth in Jeopardy

Strategies to Ease the Burden

To address debt distress, the government has committed to fiscal reforms. It plans to rely more on concessional loans, extend the maturity period of its bonds, and develop the domestic debt market. Additionally, boosting exports and remittances is a key strategy to improve the country’s financial standing.

What Lies Ahead?

Kenya’s debt situation is at a crossroads. While debt remains technically sustainable, the risk of distress is growing. The government’s ability to stick to its debt reduction roadmap will determine whether Kenya can avoid financial instability in the coming years.