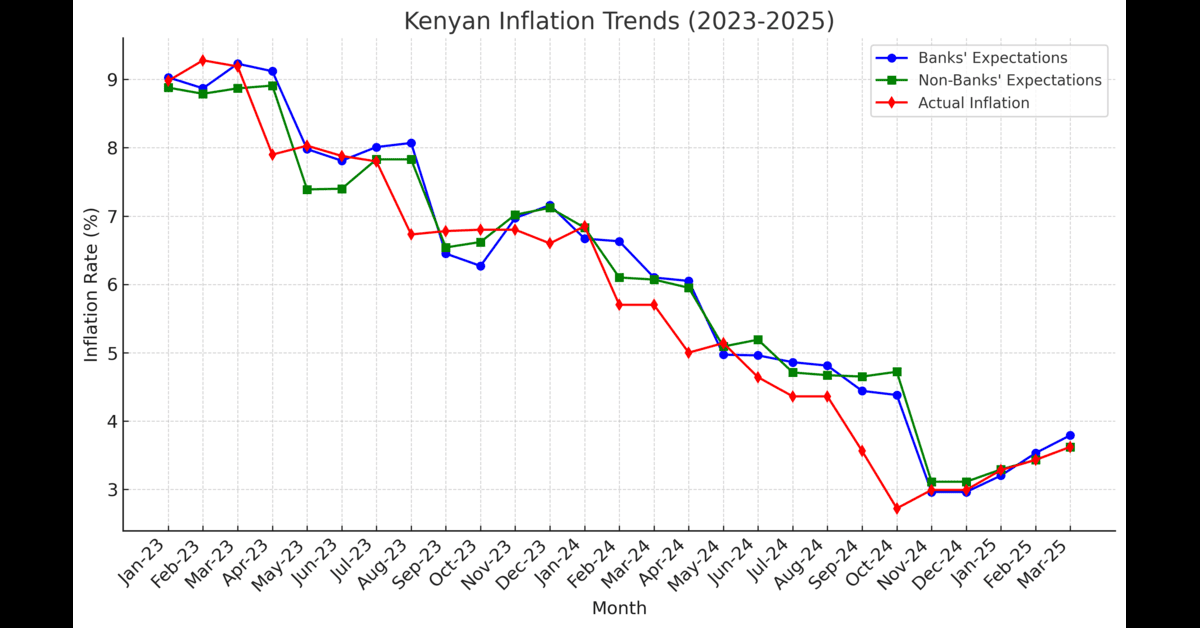

The latest Market Perceptions Survey by the Central Bank of Kenya (CBK) reveals that inflation should remain stable in the short and medium term. Respondents anticipate lower inflationary pressures due to moderating global oil prices, stable food costs, and a resilient local currency.

Inflation Trends and Expectations

Respondents project inflation to stay below the mid-point of the target range in the next three months. Lower transportation and production costs, resulting from falling fuel prices, are driving this expectation. Also, a stable Kenyan Shilling is expected to ease import costs, further contributing to inflation stability.

Over the next year, businesses foresee continued price stability. Forecasters anchor their predictions on favorable weather conditions, which they expect will boost agricultural output and sustain global economic stability. However, geopolitical uncertainties and unpredictable climate conditions could still impact inflation trends.

Inflation’s Impact on Economic Activity

The survey highlights that lower inflation is likely to stimulate economic growth. Businesses expect a reduction in lending rates following CBK’s monetary policy easing. In turn, this should spur private sector investment, increase household spending, and drive demand for goods and services.

Related Article: CBK Interest Cuts: What To Know Now!

A stable inflation environment should support employment growth. However, some firms remain cautious about expanding their workforce due to ongoing taxation policies and government austerity measures.

Inflation and Credit Growth Expectations

With inflation projected to remain low, banks anticipate increasing private-sector credit growth. Reduced lending rates should encourage borrowing for working capital and business expansion. However, some respondents raised concerns about credit risk, which could slow lending to specific sectors.

Related Article: Massive Rate Cut! Businesses to Save More on Loans

Business Optimism in 2025

Despite external economic uncertainties, respondents remain optimistic about Kenya’s financial outlook. The expected decline in inflation, combined with a stable exchange rate and a favorable business environment, strengthens confidence in future economic prospects. However, taxation policies and global economic trends remain key factors to watch in the coming months.

The Market Perceptions Survey paints a picture of cautious optimism, with inflation stability providing a foundation for economic growth and investment in 2025.