Category: Kenya

-

Kenya’s agriculture sector faces rising prices but holds an optimistic outlook, with expected output growth, government support, and calls for better infrastructure.

-

Treasury Bonds saw strong demand, with bids reaching Kshs. 193.89B. CBK accepted Kshs.130.8B, highlighting investor confidence in government securities.

-

KBA’s 2024 survey shows rising banking satisfaction, greater digital adoption, and increased customer loyalty, but high fees and service issues persist.

-

Kenyans face financial struggles but remain resilient, cutting expenses, seeking side hustles, and prioritizing savings for a stable future.

-

CEOs remain optimistic about Kenya’s 2025 business growth, focusing on diversification and innovation despite concerns over taxation and high costs.

-

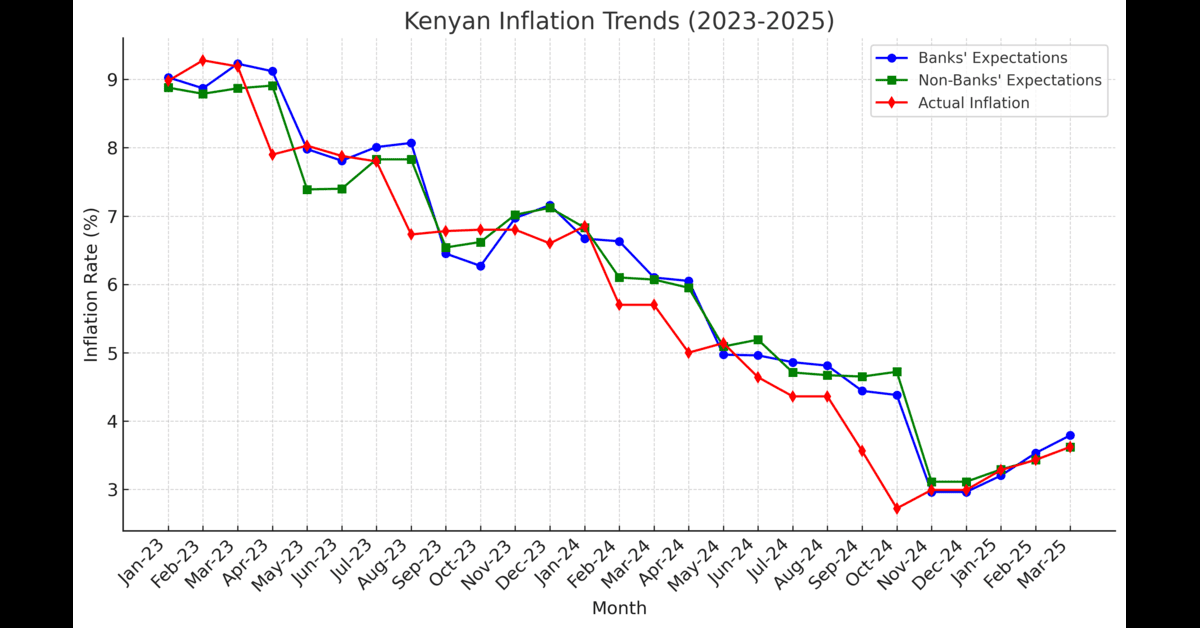

Inflation Stabilizes Amid Economic Optimism in 2025: Inflation should stay low, boosting economic growth, private sector credit, and business confidence.

-

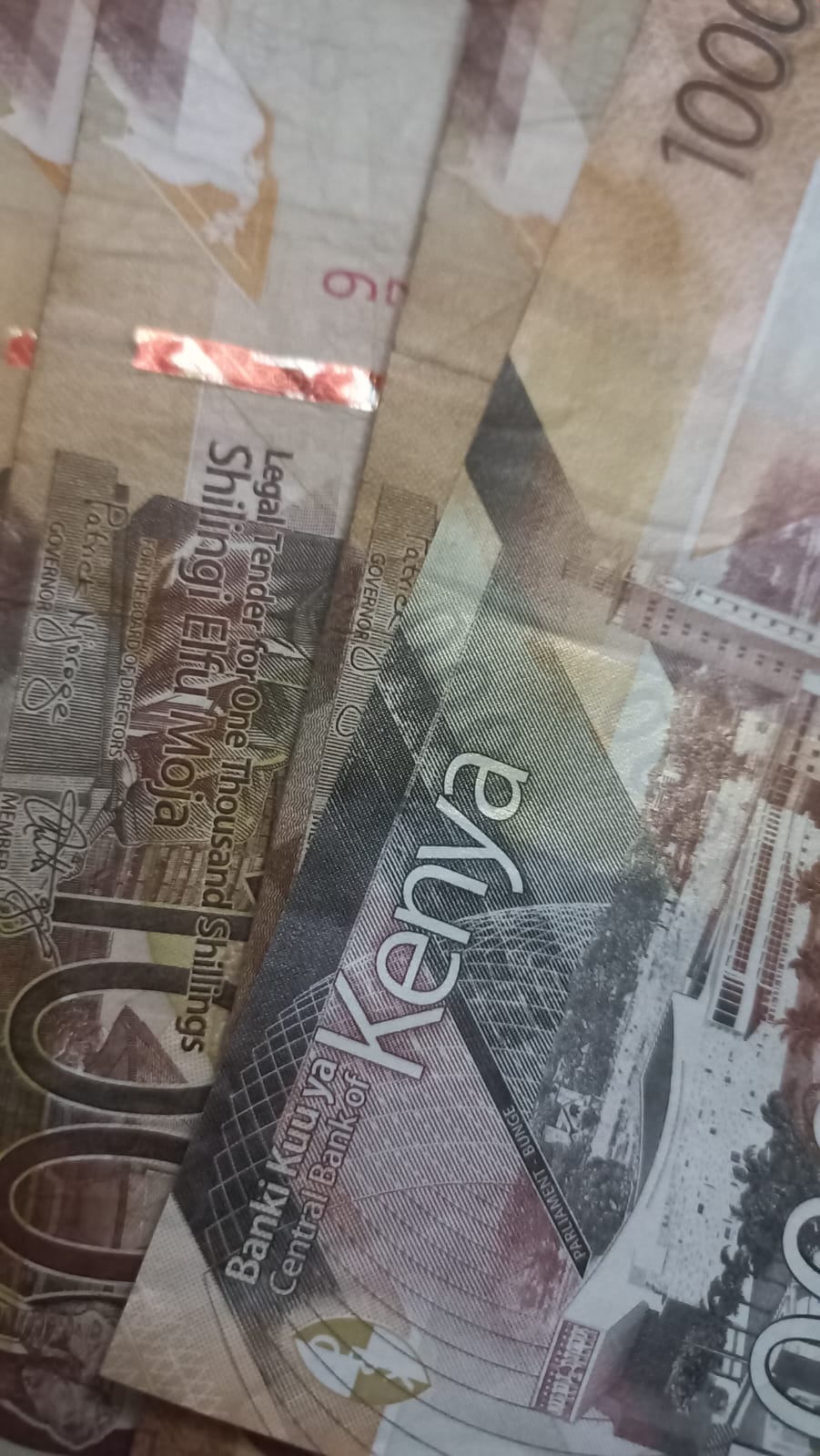

CBK wins a prestigious global award for its new high-security banknotes, recognized for cutting-edge anti-counterfeiting features and world-class design.

-

Big Relief! Lower Lending Rates Fuel Business Growth – Co-op Bank cuts rates from 16.5% to 14.5% p.a., making credit more affordable for MSMEs and individuals.

-

The court ruled healthcare facilities permit fees unconstitutional, citing double taxation and ordering the return of confiscated medical equipment.