Category: Kenya

-

Financial struggles hit Kenya’s counties, with rising debt, low revenue, and mismanagement affecting service delivery and economic growth.

-

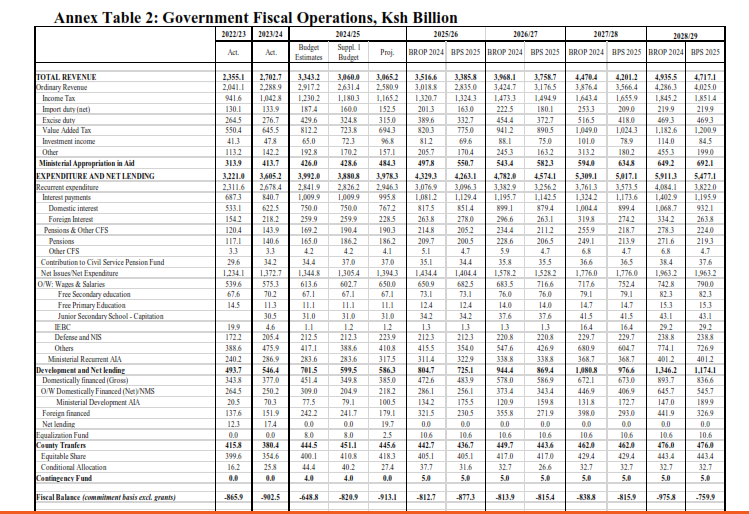

Kenya faces rising debt distress as public debt surpasses key benchmarks. The government plans fiscal reforms to ease debt pressures and ensure sustainability.

-

Kenya’s development spending fell short in FY 2023/24, raising concerns. Future projections aim for 32.6%, but budget execution remains a challenge.

-

The Hustler Fund has disbursed Ksh 60B, benefiting millions, boosting SMEs, empowering women, and fostering financial inclusion in Kenya.

-

Men dominate Hustler Fund borrowing, with only 8.8 million out of 24.6 million borrowers being women, highlighting a gender gap in financial access.

-

Kenyan businesses are opting for smaller shops to cut costs and boost accessibility, reshaping the retail landscape with strategic, community-based outlets.

-

Kenyans prefer in-office work as demand for office spaces remains strong despite global remote trends, with stable rents and a shift towards sustainable buildings.