The Kenya Revenue Authority (KRA) is offering taxpayers a golden opportunity with the KRA Amnesty program. The initiative provides a 100% waiver on penalties and interest for outstanding taxes until December 31, 2023. To benefit from this limited-time relief, taxpayers must file and pay their principal tax.

KRA Amnesty: What You Need to Know

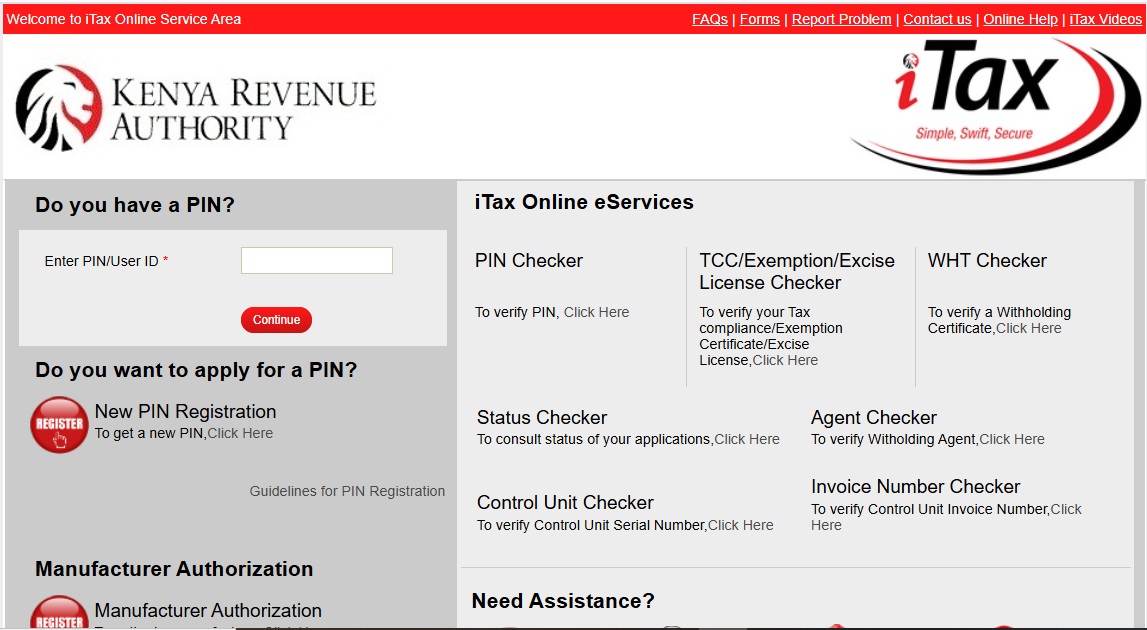

The tax amnesty is a lifeline for individuals and businesses with unpaid taxes. By clearing their outstanding principal tax, taxpayers can avoid heavy penalties and interest. The iTax platform is the official portal where taxpayers can apply for this relief.

The KRA Amnesty program encourages taxpayers to follow tax laws and provides financial relief. It allows businesses and individuals to reset their tax records without additional costs. Many taxpayers struggle with accrued penalties, making it difficult to settle their debts. The initiative offers a much-needed fresh start for those facing tax challenges.

Related Article: Budget 2025: What Kenyans Love & Hate About It

How to Apply for KRA Amnesty

Applying for the KRA Amnesty is simple:

- Log in to iTax – Visit the official portal.

- File any outstanding tax returns – Ensure all records are up to date.

- Pay the principal tax – Clear the amount owed.

- Enjoy 100% amnesty – Penalties and interest will not be applied.

The iTax system is user-friendly, allowing taxpayers to apply easily from anywhere. The KRA has also provided a dedicated support team to assist those who need help with the process.

Why the Amnesty Matters

The program benefits taxpayers by:

- Reducing financial stress – No extra fees on past tax debts.

- Encouraging compliance – A fresh start with clean tax records.

- Boosting business growth – More cash flow without penalty payments.

- Improving economic stability – More businesses remain operational.

Taxpayers should take advantage of the limited-time opportunity to settle their tax obligations without extra costs. The KRA Amnesty expires soon, so act fast. Apply today via iTax and take advantage of this tax relief!